Nasdaq has promoted corporate responsibility for over a decade, playing its part in creating a more efficient and sustainable capital market system. Today, Nasdaq Global Head of Sustainability Evan Harvey and his team are at a nexus of companies, regulators, and investors working to enhance environmental, social and governance (ESG) disclosure.

Since 2014, the cost of ESG-related scandals and controversies at S&P 500 companies has amounted to $534M losses in market capitalizations—and that number is rising. After California power company PG&E’s recent bankruptcy filing and subsequent stock market plunge, forecasted outages due to risk of wildfires could cost the state economy more than $2B.

ESG is a data-driven attempt to understand long-term performance, and Nasdaq has co-authored reports that assist companies in identifying and disclosing ESG-related factors that are material to corporate performance, as well as addressing the gap in quality, reliable ESG data. Nasdaq is reminding capital players that the growth, transparency and standardization of ESG reporting will improve market efficiency.

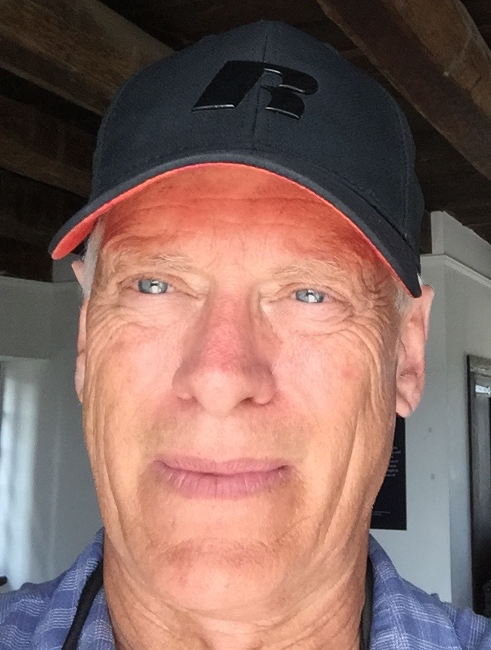

MBA student Roxi Sharif spoke with Nasdaq’s Evan Harvey about how materiality can help manage ESG data and about SDG investing and reporting.